Further information for Market Participants

Becoming a NBCP participant allows a financial institution to access the NBCP system and conduct transactions with other market participants through the platform. However, NBCP participation does not automatically confer counterparty status with the National Bank of Cambodia. Depending on the types of operation, financial institutions may separately apply to become eligible counterparties for each specific NBC instruments, which may require meeting additional eligibility criteria and signing relevant legal agreements.

The same principle applies to transactions between market participants, where participation in the platform does not replace the need for bilateral arrangements and counterparty approval for specific operations.

This section is for FIs that are already a NBC counterpart.

The NBC conducts its market operations through designated electronic platforms, NBCP. Participants are expected to submit bids or requests through the platform to minimise operational risk and ensure transparency and efficiency.

In the event of technical issues or unavailability of the system, the NBC may permit alternative submission arrangements under predefined procedures. Such submissions are processed on a fall back Facility and require verifying participant eligibility and the identity of submitting dealers before accepting bids.

When the NBC provides liquidity through its facilities, it requires eligible collateral to protect against counterparty risk. Collateral must be of sufficient quality and value to ensure the event of non-repayment.

Eligible collateral may differ across facilities and may include government securities, central bank instruments, and other approved assets. Collateral is subject to valuation, risk assessment, and eligibility checks before it can be used in NBC’s operations.

Depending on the operations, it may require haircuts to the market value of collateral to protect against price volatility and liquidation risk. Higher-quality and more liquid assets generally attract lower haircuts, while less liquid or higher-risk or longer maturity assets attract higher haircuts. Haircuts may be adjusted over time to reflect changes in market conditions or asset risk characteristics.

In some cases, additional risk adjustments may be applied to address specific counterparty or collateral risks. The NBC reviews its collateral framework periodically to ensure that it remains robust, risk-sensitive, and aligned with market developments.

We encourages participants to pre-position eligible collateral in advance of auction and potential liquidity needs. Pre-positioning allows the us to complete valuation, haircut calibration, and pledge or ownership transfer ahead of time, enabling faster and more efficient access to liquidity facilities when required.

For certain asset types, the NBC may apply diversification or concentration limits to reduce risk exposure. Participants are expected to monitor their collateral portfolios accordingly and maintain ongoing compliance with NBC’s collateral management requirements.

Through clear eligibility standards, collateral frameworks, and operational procedures, the market operations support:

Effective liquidity management in the banking system,

Sound risk management practices among NBCP members, and

Confidence in our roles as both a market operator and a market participant.

Please find sample forms below.

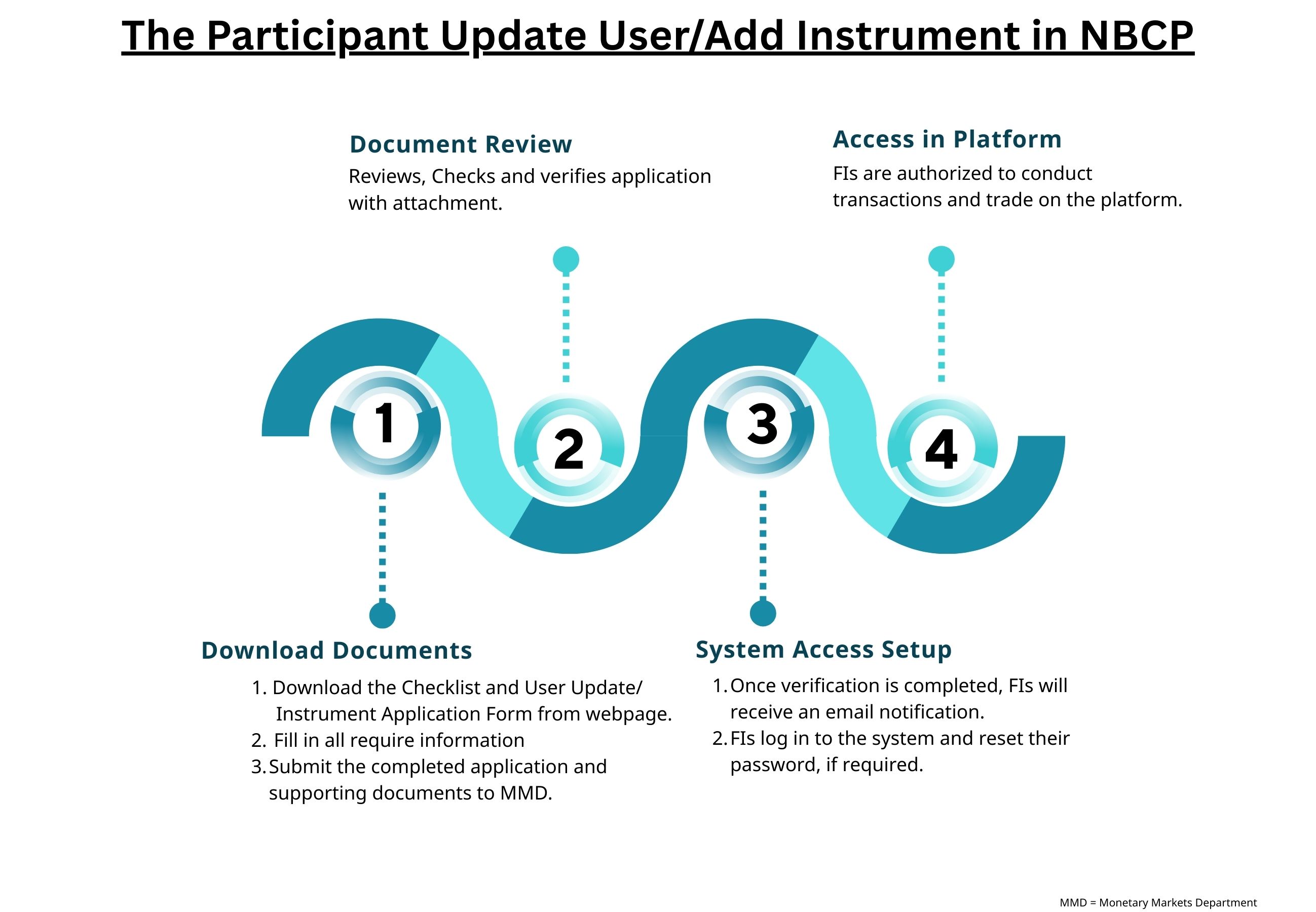

Please find application timeline below

Click link below to download file:

The following table contains a schedule of frequency and maturity of our Monetary Operations of the 1st quarter of 2026.

| No. | Settlement Date | Tenor & Maturity Date | |||

|---|---|---|---|---|---|

| 7 Days | 91 Days | 182 Days | 364 Days | ||

| 2026W1 | 1/8/2026 | 1/15/2026 | 4/9/2026 | 7/9/2026 | 1/13/2027 |

| 2026W2 | 1/15/2026 | 1/22/2026 | 4/17/2026 | 7/16/2026 | 1/14/2027 |

| 2026W3 | 1/22/2026 | 1/29/2026 | 4/23/2026 | 7/23/2026 | 1/21/2027 |

| 2026W4 | 1/29/2026 | 2/5/2026 | 4/30/2026 | 7/30/2026 | 1/28/2027 |

| 2026W5 | 2/5/2026 | 2/12/2026 | 5/7/2026 | 8/6/2026 | 2/4/2027 |

| 2026W6 | 2/12/2026 | 2/19/2026 | 5/15/2026 | 8/13/2026 | 2/11/2027 |

| 2026W7 | 2/19/2026 | 2/26/2026 | 5/21/2026 | 8/20/2026 | 2/18/2027 |

| 2026W8 | 2/26/2026 | 3/5/2026 | 5/28/2026 | 8/27/2026 | 2/25/2027 |

| 2026W9 | 3/5/2026 | 3/12/2026 | 6/4/2026 | 9/3/2026 | 3/4/2027 |

| 2026W10 | 3/12/2026 | 3/19/2026 | 6/11/2026 | 9/10/2026 | 3/11/2027 |

| 2026W11 | 3/19/2026 | 3/26/2026 | 6/19/2026 | 9/17/2026 | 3/18/2027 |

| 2026W12 | 3/26/2026 | 4/2/2026 | 6/25/2026 | 9/25/2026 | 3/25/2027 |